REE MARKET - SUPPLY AND DEMAND

The abundancy of an element in the crust is not the deciding factor when it comes to the market supply and demand. Compared to similarly abundant elements in nature such as copper (approx. 20 million tonnes annual production), the rare earth elements (REE) market is small with only 175,000 tonnes per annum production of rare earth oxides (REO).

On the other hand, this is more than the annual production of Cobalt (approx. 100,000 tpa) and Lithium (approx. 50,000 tpa). At an individual level per element, the annual production of various REO varies between less than 1,000 tonnes to over 40,000 tonnes per year. Nevertheless, REE have become vital to technologies at the heart of clean energy initiatives worldwide and have become the critical enablers of technologies that have pervaded society.

REE’s Are Critical To Modern Life

The abundancy of an element in the crust is not the deciding factor when it comes to the market supply and demand. Compared to similarly abundant elements in nature such as copper (approx. 20 million tonnes annual production), the rare earth elements (REE) market is small with only 175,000 tonnes per annum production of rare earth oxides (REO).

On the other hand, this is more than the annual production of Cobalt (approx. 100,000 tpa) and Lithium (approx. 50,000 tpa). At an individual level per element, the annual production of various REO varies between less than 1,000 tonnes to over 40,000 tonnes per year. Nevertheless, REE have become vital to technologies at the heart of clean energy initiatives worldwide and have become the critical enablers of technologies that have pervaded society.

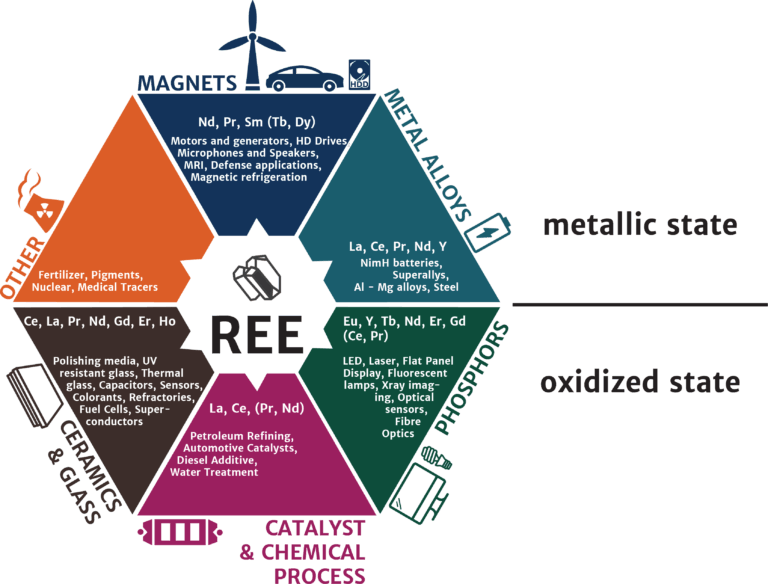

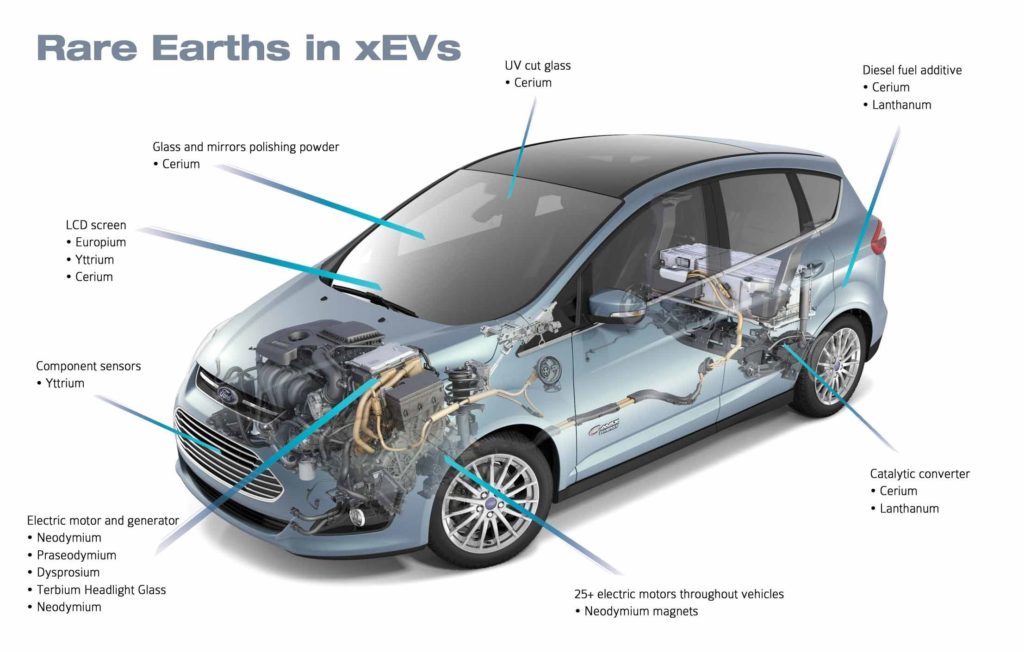

Rare earth magnets, or neodymium iron boron (NdFeB) magnets use the elements Neodymium (Nd), Praseodymium (Pr) and to a lesser extent Dysprosium (Dy), Terbium (Tb) and Holmium (Ho). These magnets are stronger per unit weight and volume than any other magnet type, which makes them part of all modern electric motors to increase efficiency and reduce energy consumption.

REE magnets are a key factor in developing sustainable energy alternative technologies to coal, oil and gas and reducing carbon emissions. More on rare earth magnets key applications (wind power & EV) below.

REE have become a cornerstone of global governments initiatives aimed at improving energy efficiency, increasing renewable power generation capacity and, reducing greenhouse gas emissions.

REE Global Demand & China’s Stronghold

Global demand and production of rare earth oxides (REO) has shifted significantly since 1950’s when it began. Early production came from monazite minerals in South Africa, India and Brazil and from Mountain Pass mine in the USA.

Global demand of below 10,000 tonnes per year in the late 1950’s and early 1960’s, more than tripled by mid 1980’s to 30,000 tpa (tonnes per year). Demand was driven by FCC catalysts, color televisions and SmCo magnets.

China began emerging as an important producer by the mid-1980’s when it reached production of 10,000 tpa. Rare earth magnets represented only 3% by volume and value of the market at the time which was estimated at approximately $250M US.

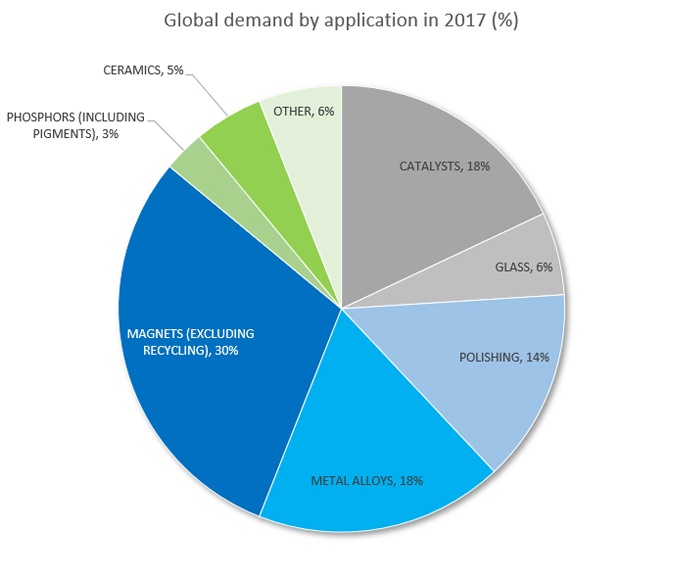

Rare Earth Elements demand today is estimated at ~ 175,000 tpa and $3 – $5B US in value, with Rare Earth Oxides for magnets representing ~30% by volume and 80% by value of the REO market. |

That market has grown to $500M US by mid 1990’s with up to 55,000 tpa demand of REO with China supplying up to 40% of that demand.

The discovery of NeFeB magnets and usage of REE in polishing powders became a major growth driver in the industry. By 2005, China became the major supplier of REO as the market reached 100,000 tpa and the major consumer, as it began advancing the value added industry for REE.

REE for magnets reached approximately 30% by volume and 40% by value of the market which reached approx. $1B US at the time.

From 2008 to 2011, a major conflict on REE export from China to Japan and subsequent cuts in export quotas drove REO prices significantly higher. This drove a major surge in illegal production in China and global demand began dropping due to high prices and shift in R&D to develop alternatives to REE.

With REO pricing dropping in the subsequent year, REO demand reached 150,000 tpa in 2015 and today it is estimate at approximately 175,000 tpa and $3-$5B US in value with REO for magnets representing approximately 30% by volume and 80% by value of the REO market.

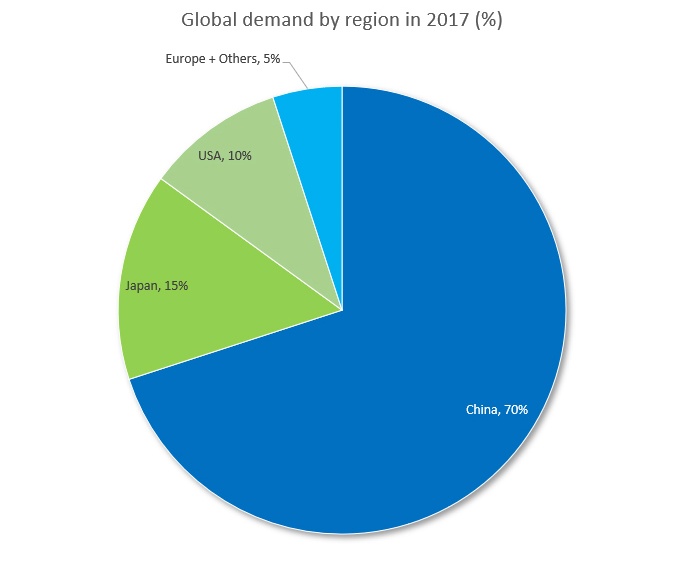

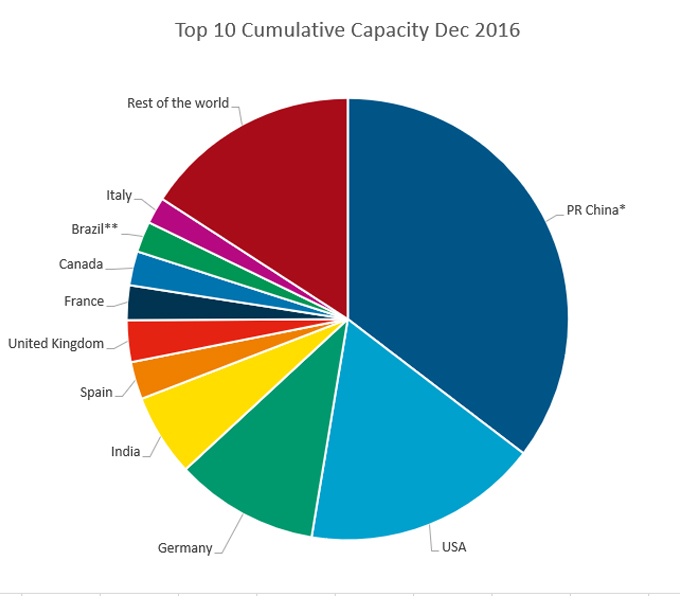

China is currently the leading supplier with over 85% of global production and the major consumer with over 70% of global demand.

REE’s have been deemed critical and strategic to national interests by governments around the world due not only to China’s stronghold in the market, but also to the devastating environmental effects caused by China’s archaic mining methods.

This has resulted in an effort from Western nations to produce cleaner processing technologies and increase investment in environmentally responsible recycling of Rare Earth magnets.

Major Permanent Magnet Applications

Wind Turbines (source GWEC Global Wind Report April 2018)

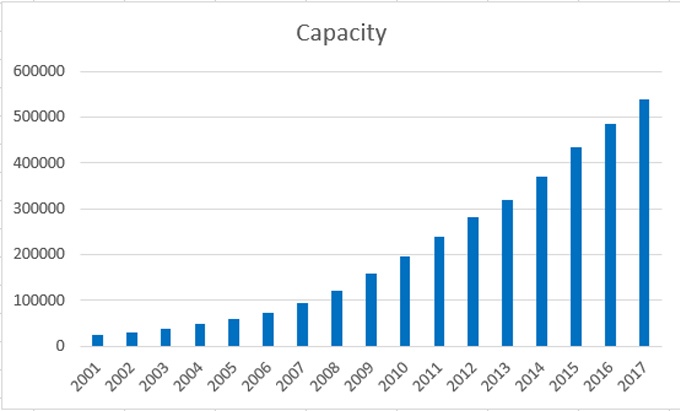

Permanent magnets have helped increase the efficiency of wind turbines, especially in light winds, while making them cheaper, lighter and more reliable and cheaper to maintain. Wind turbines with direct drive technologies do not use a gearbox which helped reduce significantly the maintenance required for turbines. This is a major advantage especially for offshore installations. Direct drive wind turbines help bring wind turbines to areas with lower winds where previously the technology was not applicable.

It is estimated that a 3MW direct drive turbine consumes up to 2 tonnes of NdFeB magnets in the generator. The image below from GE, a world leader in wind power, demonstrates how a wind turbine works and the full website can be accessed here: https://www.ge.com/renewableenergy/wind-energy/turbines

The cumulative global wind power installations in 2017 accounted for 539,123 MW out of which 3.5% are offshore applications which are growing quickly. Wind power is becoming a fully commercialized, unsubsidized technology which is competing in the marketplace against fossil and nuclear power. In 2017, $107B were invested in the wind industry. Prices for wind power continue to drop with new projects offering $0.02 and $0.03/kWh.

China is the global leader in wind power capacity with 188,392 MW, followed by USA (89,077 MW) where wind power generated 6.3% of total US power in 2017. Canada is 9th with 12,239 MW delivering 6% of the country’s electrify. There are 295 wind farms made up of over 6,400 wind turbines operating in Canada, bringing economic development and diversification to rural communities through land lease income, property tax payments, ownership revenue and community benefits agreements.

Electric Vehicles (EV) (source: https://www.iea.org/gevo2018/, and various car manufacturers and government announcments)

All vehicles use rare earth elements in many different applications and especially in permanent magnets that are used in many small and medium motors in the vehicle which reduce the weight of the vehicle contributing to energy savings and reduction of CO2 emissions.

Most importantly it is the shift to permanent magnet alternating current (PMAC) motors in EVs that is driving demand for rare earths like Nd and Pr. Tesla Inc. transitioned their vehicles from induction motors to PMAC with their Tesla 3 model (https://electrek.co/2018/02/27/tesla-model-3-motor-designer-permanent-magnet-motor/ and https://insideevs.com/chief-motor-engineer-tesla-model-3-motor/).

It is believed that over 90% of electric vehicles now use NdFeB permanent magnet based motors with each motor representing approximately 3kg of magnet or 1kg of Nd or NdPr for a medium size personal vehicle. Over 1M EV were sold in 2017 and there were more than 3M EVs in circulation at the end of 2017.

CO2 emissions regulations are continuing to improve with current levels of 100 g CO2/km expected to drop below 100 g CO2/km in the next 10 years which will require more and more adaptation of EVs. Many countries such as India, France, UK, Netherlands, Norway and others have already set ambitious goals to fully ban new sales of internal combustion engine (ICE) vehicles as of 2030 and 2040. Japan is targeting 30% new EV sales in 2030 while several US states are targeting 3M+ EVs by 2025 and China is targeting 20% of production and sales in 2025 to be EVs.

The global automotive industry has already committed over $400B US investments in EVs over the next 10 years with up to 700 models expected to be announced by 2030.